At Greenbank, we invest across the responsible, sustainable and impact-driven approaches.

The ‘spectrum of impact’ is a way of mapping the broad range of risk and return strategies within the field of responsible investment.

Responsible and sustainable investment

Understanding the wider social and environmental impact of our holdings is a fundamental part of our investment process across the different approaches we apply. Prior to investing, potential holdings are screened to ensure they meet a minimum threshold of environmental, social and governance performance. Beyond this, companies are selected or excluded based on clients’ financial objectives and their specific impact priorities (positive screening) and concerns (negative screening).

Impact-driven investments

Investors are increasingly seeking to achieve a positive social or environmental impact alongside financial returns. This approach is referred to as ‘impact investing’ and is defined by the Global Impact Investing Network (GIIN) as “investments made with the intention to generate measurable positive social and environmental impact alongside financial return”. Under the broad category of impact investing, there are a number of more specialised approaches, including social enterprise investment and ‘impact first’ investment. These approaches vary according to the balance between financial, social or environmental returns being sought.

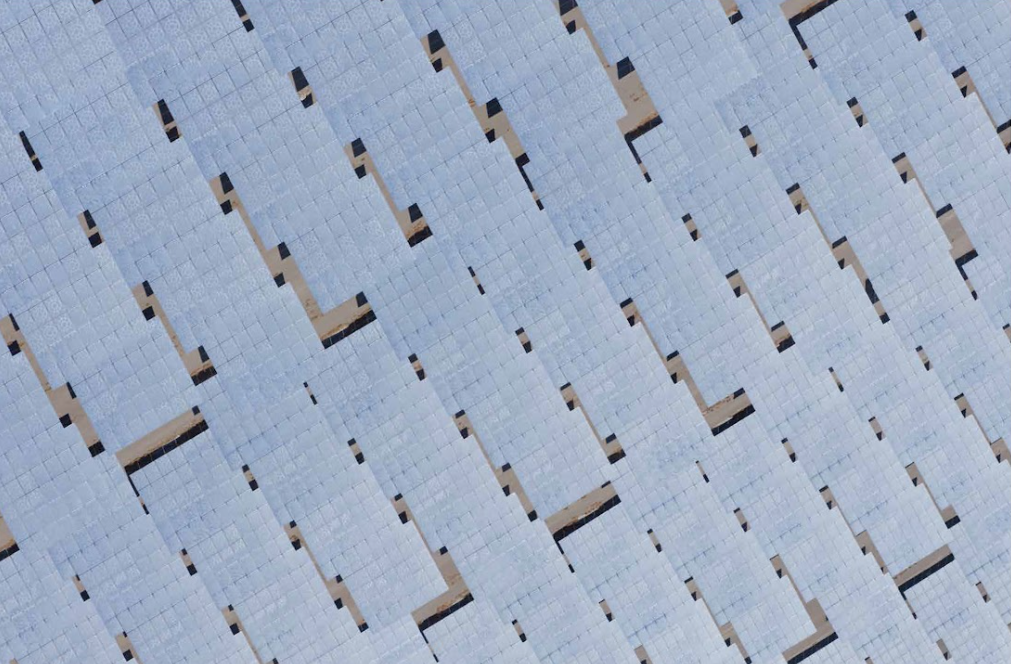

Greenbank was one of the first private client investment management teams to implement such an approach and has made over 40 impact-driven investments since 2000. Investments have been made across multiple themes including social housing, sustainable transport, renewable energy, microfinance, and care provision for underserved groups such as the elderly, people with learning difficulties and ex-offenders.

While we seek a fair financial return from such investments, they are generally only appropriate for clients and trustees prepared to take on the additional risk inherent in such opportunities. For many impact investors this increased risk is balanced by the strong positive social or environmental impact generated.